The Of Clark Finance Group Refinance Home Loan

Table of ContentsThe smart Trick of Clark Finance Group Home Loan Lender That Nobody is DiscussingRefinance Home Loan - TruthsNot known Incorrect Statements About Refinance Home Loan Some Ideas on Clark Finance Group You Need To Know

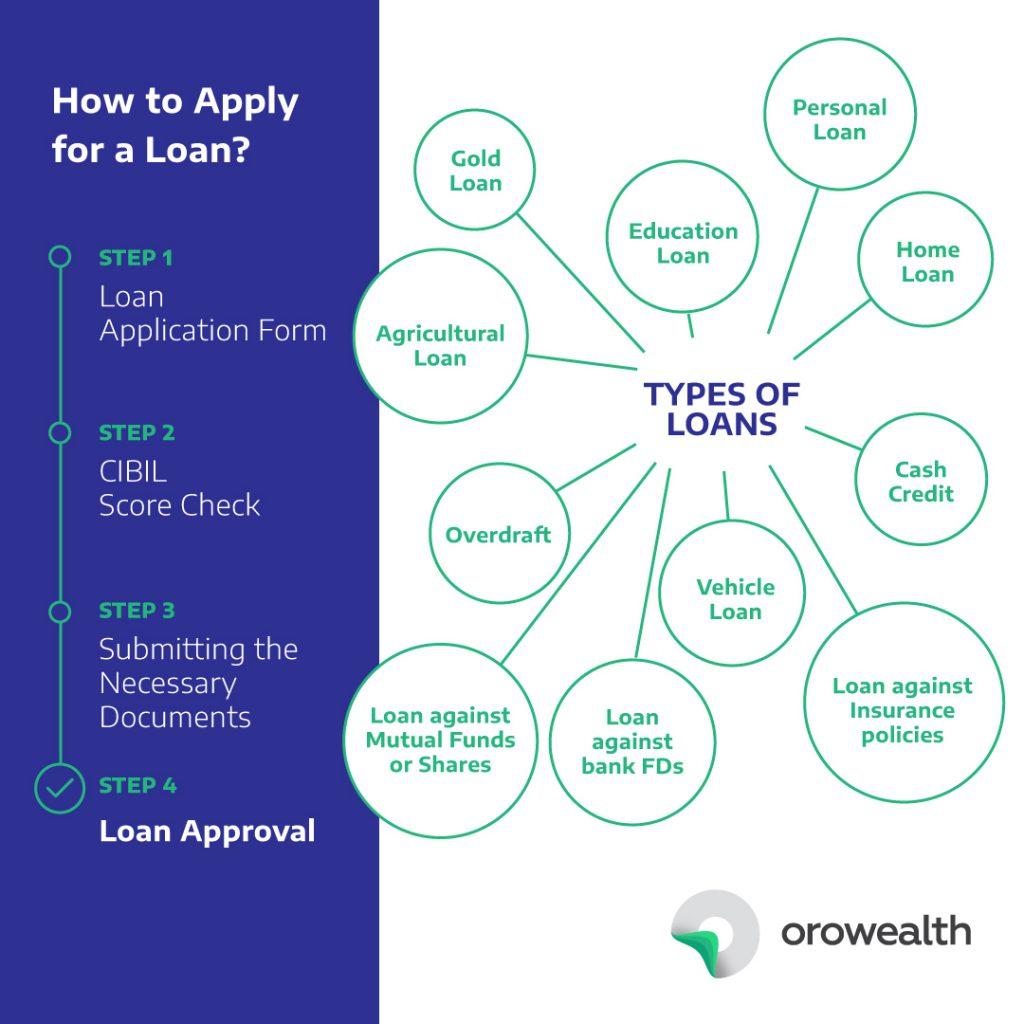

All car loans aren't developed equal. If you require to obtain cash, first, you'll desire to make a decision which kind of financing is right for your situation.

If you have high-interest charge card financial debt, a personal financing might help you settle that financial obligation faster. To settle your financial obligation with a personal car loan, you 'd look for a loan in the quantity you owe on your credit rating cards. If you're accepted for the full quantity, you 'd use the funding funds to pay your credit cards off, instead making monthly settlements on your personal funding.

That's because the lending institution may take into consideration a secured loan to be less risky there's a property supporting your car loan. If you do not mind promising security and you're confident you can repay your car loan, a protected car loan might aid you conserve cash on rate of interest. When you utilize your security to secure a lending, you run the threat of shedding the residential or commercial property you offered as collateral.

Home Loan Lender for Beginners

You'll take an item of worth, like a piece of precious jewelry or a digital, into a pawn shop and obtain cash based on the product's worth. Loan terms differ based on the pawn store, as well as interest rates can be high.

You might also get struck with fees and also additional prices for storage space, insurance policy or renewing your financing term. A payday choice funding is a short-term finance supplied by some government lending institution. A buddy is designed to be a lot more budget-friendly than a payday advance. Payday alternate funding amounts range from $200 to $1,000, and also they have much longer payment terms than payday advance loans one to 6 months as opposed to the regular few weeks you obtain with a payday advance (Clark Finance Group Mill Park).

A house equity finance is a type of secured lending where your residence is used as collateral to borrow a round figure of money. The quantity you can obtain is based upon the equity you have in your home, or the difference between your home's market value as well as just how much you owe on your home.

Considering that you're utilizing your home as collateral, your rate of interest with a house equity funding may be less than with an unsafe individual car loan. You can use your house equity loan for a variety of objectives, ranging from residence renovations to medical costs. Prior to taking out a home equity funding, ensure the settlements remain in your spending plan.

Indicators on Clark Finance Group Refinance Home Loan You Need To Know

She enjoys assisting individuals discover means to much better manage their cash. Her job can be located on numerous websites, consisting of Bankrate, Financing, Bu Read more. Read Much more.

Below are the most usual types of financings and also just how they work. Secret Takeaways Personal lendings as well as credit cards come with high interest prices yet do not require security.

Money developments generally have very high rates of interest plus deal fees. Personal Car loans A lot of banks, online as well as on Key Street, use personal financings, and also the earnings might be used for essentially anything from purchasing a new 4K 3D smart TV to paying expenses. This is my link a pricey method to obtain cash, since the funding is unsecured, which implies that the debtor doesn't install security that can be seized in case of default, just like a vehicle loan or house mortgage.

Not known Details About Mortgage Broker

Passion rates can be more than three times that amount: Avant's APRs vary from 9. Continue 95% to 35. 99%.

Bank Car loan vs. Bank Assurance A bank car loan is not the like a bank guarantee. A bank may provide a warranty as surety to a 3rd party in support of one of its customers. If the consumer stops working to accomplish the pertinent contractual obligation with the 3rd party, that celebration can require payment from the financial institution.

A firm might accept a specialist's proposal, as an example, on the problem that the contractor's bank problems an assurance of repayment in the occasion that the contractor defaults on the contract. An individual loan could be best for someone that requires to borrow a reasonably small quantity of money visit this site right here and also is certain of their ability to settle it within a couple of years.